- Activ8Insights Newsletter

- Posts

- Weekly Wrap-Up: Sunday, 10/5/25

Weekly Wrap-Up: Sunday, 10/5/25

Last week brought a flurry of activist short reports targeting companies across multiple sectors. Fuzzy Panda Research exposed Rezolve AI as a ChatGPT wrapper with fake partnerships and declining acquired revenue, triggering a 16% intraday plunge before shares recovered to close down 12%. Manatee Research released their inaugural short report questioning Slide Insurance's claims handling practices and regulatory troubles, initially sending shares down 11%, though the stock ultimately reversed to finish the week up 6%. Capybara Research unveiled extensive fraud allegations at Richtech Robotics including embezzlement and criminal ties, causing an initial 6% drop before shares staged a dramatic 51% short squeeze by week's end. Spruce Point warned that DraftKings faces existential disruption from prediction markets like Kalshi, with The Bear Cave publishing a follow-up report echoing similar concerns, though the market barely reacted with shares essentially flat. Meanwhile, we kicked off our "Short Selling Around the World" series examining how Latin American shorts face unique risks from political volatility, currency controls, and corporate opacity that can sink even the soundest thesis.

Fuzzy Panda Research Short Report on Rezolve AI (NASDAQ: RZLV)

Report Impact on Stock Price

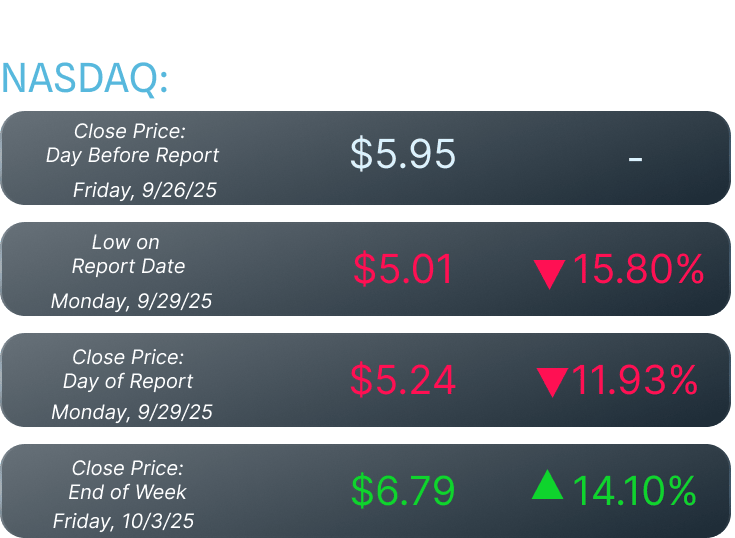

Fuzzy Panda's report alleging Rezolve AI is a ChatGPT wrapper with fake partnerships triggered an immediate 16% decline on September 29th, with shares falling from a $5.95 close the prior day to an intraday low of $5.01. The stock recovered somewhat to close at $5.24, down 12% from the pre-report close. By week's end, shares had rebounded to $6.79, finishing 14% above the pre-report baseline as traders debated the allegations.

Who is Rezolve AI?

Rezolve AI is a UK-based company listed on Nasdaq that rebranded itself as an "AI company" in mid-2023. Previously known as "Rezolve Instant Saleware," the company is led by CEO Dan Wagner, who has a notorious history of failed ventures including Powa Technologies, a $2.7 billion "unicorn" that collapsed into bankruptcy. Rezolve claims to offer proprietary AI solutions but generated only $190,000 in 2024 revenue, all from Spanish soccer ticket sales with zero dollars from AI products.

Key Points from the Report

ChatGPT Wrapper, Not Proprietary AI – Former employees and technical disclosures confirm Rezolve's "Brainpowa LLM" is simply a ChatGPT wrapper with no competitive moat, despite claims of proprietary technology that doesn't hallucinate.

Fake Partnerships with Tech Giants – Rezolve paid Microsoft $147.7 million and Google $10 million while claiming them as "strategic partners," yet their Azure app has zero reviews after one year and generates no meaningful revenue.

Fabricated Growth Through Failing Acquisitions – The company acquired struggling AI startups ViSenze and GroupBy with declining revenue (down 31% and 5% respectively) to fake ARR growth, falling far short of their $70-100M target.

Blatant Self-Dealing and Insider Enrichment – CEO Wagner's Seychelles entity received $93.9 million in share-based payments while the company generated only $330K in sales, and Wagner flipped Bluedot Industries to Rezolve for $3.9 million after buying it for $10 thirteen months earlier.

Pattern of Deception Across Customer Claims – All major customer case studies are recycled from acquired companies, not organic wins, including Liverpool Mexico (a pre-existing GroupBy customer) and exaggerated claims about Dunkin Donuts deployments that former executives say served "like 100 people."

Manatee Research Short Report on Slide Insurance (NASDAQ: SLDE)

Report Impact on Stock Price

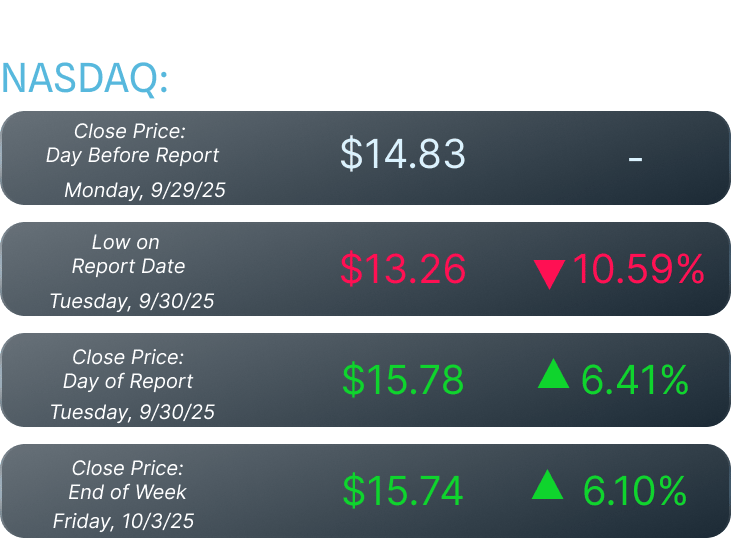

In Manatee Research's debut short report, their allegations of aggressive claim denials and regulatory troubles with three executives initially pushed Slide Insurance down 11% to an intraday low of $13.26 on September 30th from the prior close of $14.83. However, the stock quickly reversed course, closing up 6% at $15.78 and maintaining that gain through week's end at $15.74, suggesting the market either dismissed the concerns or viewed the valuation as attractive despite the risks.

Who is Slide Insurance?

Slide Insurance is a Tampa-based property and casualty insurer listed on Nasdaq with a $1.9 billion market capitalization. The company is 99% concentrated in Florida homeowners insurance and is led by husband-and-wife duo Bruce and Shannon Lucas, who serve as CEO and COO respectively. Founded to capitalize on Florida's turbulent insurance market, Slide went public in June 2025 at $17 per share and currently trades around $14.83. The company manages $1.33 billion in gross premiums written across Florida, with 35% of its insured value concentrated in the state's top four hurricane-risk counties.

Key Points from the Report

Aggressive Claim Denials Drive Margins – Slide's 38.6% claim payment rate is 15 points below the peer average of 53.7%, resulting in 1,938 civil remedy notices alleging bad faith claims handling filed between January 2023 and September 2025.

Failed Insurer Executives Still Employed – Florida regulators demanded the removal of three executives from collapsed St. Johns Insurance (President/CFO Jesse Schalk, SVP Operations Jonathan Mertz, and SVP Claims Andrew Lambert), yet they remain at Slide despite regulatory warnings of potential certificate suspension.

Questionable Technology Claims – The company attributes superior performance to AI and technology, yet its AI co-founder disappeared from company records, the CIO's consulting firm operates from a residential address, and loss ratio improvements are actually attributed to third-party vendor Pinpoint Predictive.

Extreme Hurricane Exposure and Weak Oversight – With 69% of insured value on homes built before 2001 and reliance on tiny Demotech rating agency (whose insurers fail at 30x the rate of traditionally-rated carriers), Slide faces concentrated catastrophic risk in hurricane-prone Florida.

Insider Enrichment and Audit Red Flags – CEO Bruce Lucas earned $21.2 million in 2024 (double peer average), the husband-wife leadership team took $35.6 million combined in 2023-2024, and auditor Forvis Mazars showed deficiencies in 71% of PCAOB-reviewed audits including specific issues with insurance reserves testing.

Capybara Research Short Report on Richtech Robotics (NASDAQ: RR)

Report Impact on Stock Price

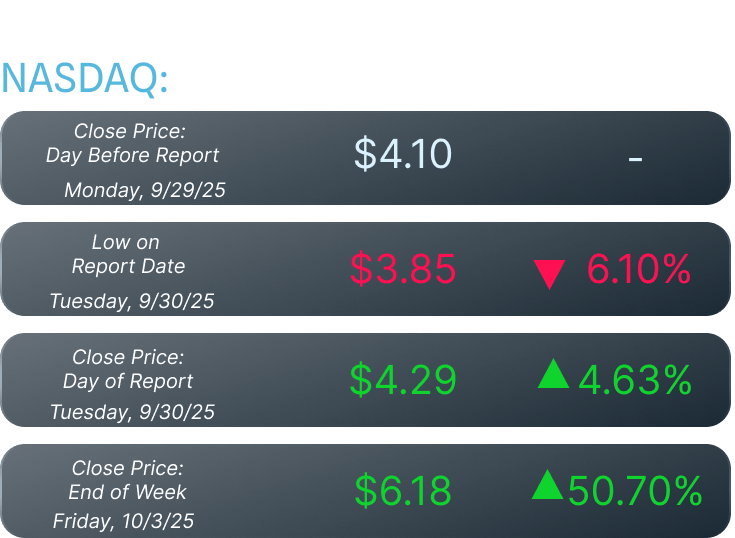

Capybara's extensive fraud allegations including embezzlement, criminal ties, and defective products initially pushed Richtech Robotics down 6% to an intraday low of $3.85 on September 30th from the $4.10 pre-report close. The stock then staged a massive short squeeze, closing up 5% at $4.29 before exploding 51% higher by week's end to $6.18, demonstrating how heavily shorted stocks can defy fundamental concerns when technical forces dominate.

Who is Richtech Robotics?

Richtech Robotics is a Nasdaq-listed company that positions itself as an American robotics manufacturer but actually operates as a distributor of Chinese-made robots. Founded in 2017 as Richtech Creative Displays, the company rebranded to focus on robotics and is controlled by CEO Wayne Huang through super-voting shares with a 10:1 ratio. Despite claims of designing and manufacturing proprietary robots in the United States, Capybara Research found that Richtech simply purchases off-the-shelf robots from Chinese manufacturers like AutoXing, Sparkoz, OrionStar, and Keenon, then rebrands them with Richtech stickers and sells them at substantial markups.

Key Points from the Report

Insider Embezzlement and Money Laundering Scheme – Bank records show Richtech wired $400,000 in four installments to a shell company controlled by accused felon Henry Leong (currently facing prosecution for identity theft and tax fraud), which immediately forwarded the funds to Skybound Innovations LLC linked to CEO Wayne Huang, mirroring Leong's previous money laundering pattern.

Fabricated Partnerships and Customer Deals – The company falsely claimed partnerships with MAC USA (employees confirmed they've "never even heard of Richtech") and hyped a major retailer contract implied to be Walmart that turned out to be only a limited floor-cleaning pilot, while MSAs touted for years represent less than 3% of actual revenue.

Defective Products and Complete Failures – The flagship ADAM robot is actually a rebranded Chinese OrionStar model from 2020 that proved so defective BotBar NYC sued for $600,000, with customers reporting constant malfunctions including cups not dispensing, coffee pouring on counters, and drinks overflowing, leading even Richtech's own franchises to abandon the product.

Criminal Ties and Suspicious Offshore Transactions – Large pre-IPO shareholder Peiyong Han is under SEC investigation for involvement in a Chinese criminal syndicate that manipulated US-listed stocks, while the company issued 22 million shares at $0.06 to mysterious BVI shell companies for undisclosed "services rendered" just before IPO'ing at $5 per share eleven months later.

Massive Dilution Despite Flat Revenue and Exploding Losses – While the stock rallied 400% on hype, shares outstanding increased 250% (from 62.2M to 153.15M), revenue remained flat, operating losses increased 300%, and the company filed a $1 billion shelf registration to sell even more shares to unsuspecting investors.

Spruce Point Management Short Report on DraftKings, Inc. (NASDAQ: DKNG)

Report Impact on Stock Price

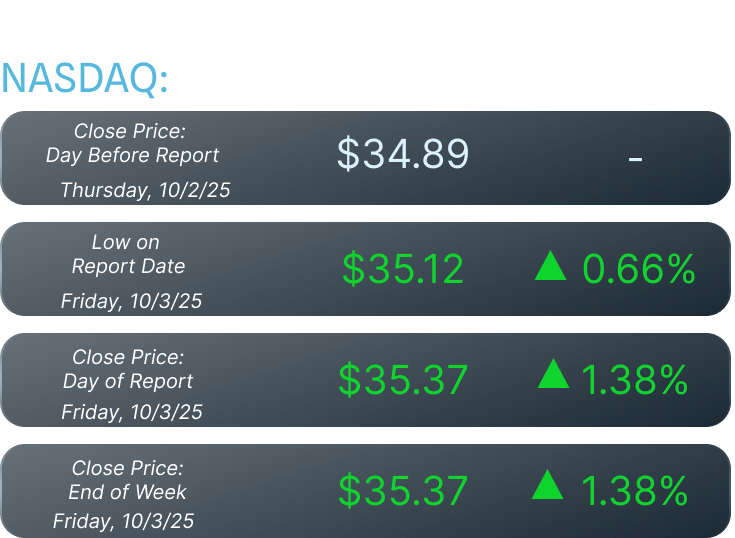

Spruce Point's warning that prediction markets pose an existential threat to DraftKings' core business model, followed by a supporting report from The Bear Cave, generated minimal market reaction. Shares barely budged from the $34.89 pre-report close, rising just 0.7% to an intraday high of $35.12 on October 3rd and closing at $35.37, up only 1.4% through week's end, suggesting investors either disagree with the thesis or believe regulatory intervention will protect traditional sportsbooks.

Who is DraftKings?

DraftKings Inc. is a publicly traded online gaming operator headquartered in the United States with a $18.9 billion market capitalization and 496 million shares outstanding. The company operates online sports betting and iGaming platforms across 26 U.S. states plus international markets, generating $4.77 billion in revenue in 2024. DraftKings is heavily concentrated in U.S. sportsbook operations, which represent 61% of total revenue compared to just 29% for competitor Flutter, making it disproportionately exposed to disruption in the American sports betting market. The company operates under state-by-state gaming licenses and faces heavy gross gaming revenue taxes at the state level.

Key Points from the Report

Kalshi Capturing Massive Market Share in Weeks – The federally-regulated prediction market generated $328 million in NFL handle during Week 4 alone (representing ~30% of DraftKings' average weekly NFL handle), while NCAA football handle of $187 million per week represents 79% of what all U.S. sportsbooks combined generated weekly in 2024.

Structurally Better Economics Favor Prediction Markets – Kalshi operates with ~1.5% transaction fees versus DraftKings' 6-8% hold rate, providing consistently better odds that attract value-seeking bettors, as demonstrated in a 12-game sample where Kalshi offered superior odds in 21 of 24 possible outcomes.

Federal Preemption Creates Unfair Competitive Advantage – While DraftKings requires state-by-state gaming licenses and pays heavy GGR taxes, Kalshi operates nationwide under CFTC federal jurisdiction with no state taxes, 18+ age access versus 21+, and appears likely to continue operating through 2026 while litigation drags on.

Trump Administration Ties Create Regulatory Tailwinds – Donald Trump Jr. serves as advisor to both Kalshi and Polymarket (via 1789 Capital investment), while Trump's CFTC nominee Brian Quintenz is an equity holder and board member at Kalshi, creating material risk of regulatory decisions favoring prediction markets over traditional sportsbooks.

Consensus Revenue Estimates Face Collapse – Spruce Point estimates DraftKings could miss 2025 consensus revenue by 6.2% ($391 million) and 2026 consensus by 15% ($1.1 billion) as Kalshi captures market share during peak football season, with 35-60% downside to current stock price if hold rates compress or if the company pivots to a prediction market model.

| Kicking off our "Short Selling Around the World" series: Latin American shorts face unique risks from political volatility, currency controls, and corporate opacity that can sink even the soundest thesis. |

Activist short sellers including Carson Block (Muddy Waters), Soren Aandahl (Blue Orca), and Dan David (Wolfpack) gathered in San Francisco this week, maintaining their research pace despite a challenging bull market, with Blue Orca publishing six to seven reports in the past year including successful calls on Baldwin Insurance and Teladoc Health.

Legal experts advise companies facing short-seller reports to annotate allegations under privilege, monitor stock reactions for litigation defense, and consider offensive tactics like cease-and-desist letters when reports contain demonstrably false statements.

Activ8Insights.com is your go-to source for everything in the world of activist short selling. We track every activist short report as it drops, publish in-depth analysis on targeted companies, and scour the web for related news and filings, so you don’t have to. Whether you're an investor, analyst, or just short-curious, we bring the red flags to your inbox in real time.

Visit our Website

Disclaimer

The information provided on Activ8Insights.com—including all articles, reports, commentary, and associated content—is intended solely for informational and educational purposes. It does not constitute investment advice, an offer, or a recommendation to buy or sell any securities. Activ8Insights does not express any opinion on the valuation or future performance of any security mentioned. All views and opinions presented aim to promote transparency and critical dialogue around activist investing—particularly short activism—but should not be interpreted as personalized financial advice. Investors are solely responsible for their own due diligence and investment decisions, based on publicly available information and their individual financial circumstances. We strongly encourage consulting a licensed financial advisor before making any investment decisions. No content published by Activ8Insights constitutes a solicitation or offer to buy or sell securities or financial instruments. Authors, contributors, or affiliates of Activ8Insights may hold long or short positions in the securities mentioned. These positions may change at any time without notice, and there is no obligation to disclose such changes after publication. Any forecasts, estimates, or forward-looking statements are speculative by nature and based on assumptions that may prove inaccurate. They are subject to risks, uncertainties, and change without notice. Activ8Insights makes no commitment to update forward-looking content. Activ8Insights disclaims all liability for any direct or consequential loss arising from the use of content on this site or associated platforms. By accessing this website or our affiliated media, you acknowledge and agree to this disclaimer and our terms of use. Unauthorized reproduction or distribution of this content is strictly prohibited and may result in legal action.