- Activ8Insights Newsletter

- Posts

- Weekly Wrap-Up: Sunday, 08/24/2025

Weekly Wrap-Up: Sunday, 08/24/2025

This week marked one of the busiest periods for activist short selling in recent memory, with nine reports published across five trading days targeting companies from hydrogen fuel cells to AI dating platforms. The week showcased the breadth of short seller focus, spanning everything from SPAC-era casualties and promotional microcaps to established healthcare companies and emerging technology players. While most targets saw initial selling pressure, several stocks demonstrated resilience, with some ending the week higher than pre-report levels, highlighting the increasingly complex dynamics between short sellers and market participants in today's environment.

Due to the high volume of short selling reports this week, we've decided to break things down a little differently.

Fugazi Research Report on Advent Technologies

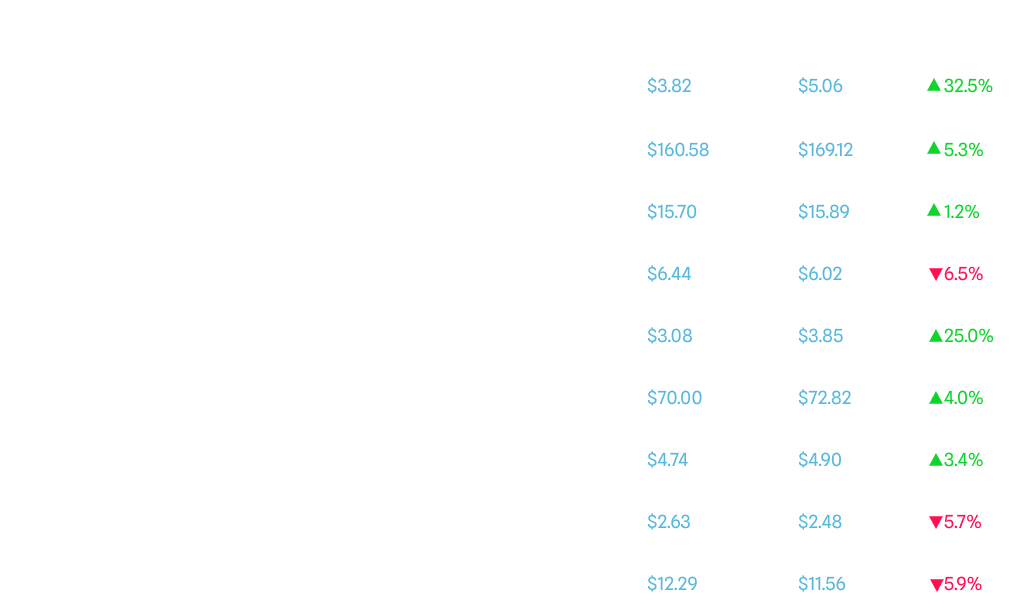

Despite Fugazi's scathing assessment of Advent as a promotional SPAC-era hydrogen play dependent on toxic financing, the stock defied expectations with a 32% gain for the week, closing at $5.06 versus the pre-report $3.82. The report highlighted Advent's 95% decline from post-SPAC highs, material control weaknesses, bankrupt subsidiaries, and reliance on Wall Street Reporter's promotional campaigns, yet buying interest emerged as hydrogen sector momentum continued.

Spruce Point Capital Report on iRhythm Technologies

Spruce Point's allegations of overstated growth prospects and reimbursement risks initially pressured shares down to $152.05, but iRhythm recovered to close the week at $169.12, up 5% from the pre-report $160.58. The report's concerns about Medicare reimbursement concentration, competitive threats from larger players like Medtronic, and aggressive accounting practices were ultimately overshadowed by the company's established position in cardiac monitoring.

Night Market Research Report on USA Rare Earth

Night Market's detailed critique of USAR's "mine-to-magnet" strategy as fundamentally flawed had minimal lasting impact, with shares ending essentially flat at $15.89 versus the pre-report $15.70. The report's technical analysis showing Round Top's ore grades at 1/100th of industry leaders and characterizing the magnet manufacturing equipment as "scrap metal" failed to derail the rare earth narrative amid ongoing supply chain concerns.

Kerrisdale Capital Report on Aurora Innovation

Kerrisdale's warning about Aurora's autonomous trucking challenges resonated more with investors, as shares declined from $6.44 to close the week at $6.02, representing a 7% drop. The report's emphasis on perpetual delays in full autonomy, massive cash burn exceeding $2 billion before meaningful revenue, and competitive disadvantages highlighted the gap between autonomous vehicle promises and commercial reality.

SHORTFINDER Report on Microbot Medical

SHORTFINDER's analysis of warrant overhang risks proved prescient as MBOT gained 25% for the week, rising from $3.08 to $3.85, yet the report's warning about hedge fund liquidation strategies provides a framework for monitoring future dilution pressure. Despite acknowledging likely FDA clearance in Q3 2025, the report detailed how 29.8 million outstanding warrants held by sophisticated investors could create persistent selling pressure regardless of positive clinical developments.

Culper Research Report on Technoglass

Culper's allegations of financial irregularities and related-party dealings in the Colombian glass manufacturer had minimal impact, with TGLS gaining 4% to close at $72.82 from the pre-report $70.00. The report's concerns about artificially inflated margins, undisclosed related-party transactions by the controlling Daes brothers, and weak governance were offset by continued strength in construction markets.

BMF Reports Report on Connexa Sports Technologies

BMF's characterization of Connexa as "a penny-stock dilution scam dressed up in AI buzzwords" failed to generate sustained selling pressure, with shares recovering to $4.90 from the pre-report $4.74. The report's documentation of multiple failed business pivots, the sale of the original Slinger Bag business for one dollar, and connections to a sanctioned auditing firm highlighted corporate governance concerns that investors appeared willing to overlook.

The Bear Cave Report on Raytech Holding Limited

The Bear Cave's warning about overseas manipulation schemes targeting Raytech proved more impactful, with shares declining from $2.63 to $2.48 for a 6% weekly loss. The report's allegation that the stock had risen 13 times its recent offering price due to coordinated manipulation targeting U.S. retail investors, combined with documented corporate governance issues, appeared to resonate with market participants.

The Bear Cave Report on GoGo Inc.

The Bear Cave's challenge to GoGo's business aviation connectivity dominance generated a 6% decline from $12.29 to $11.56, as the report argued that SpaceX's Starlink is rapidly displacing GoGo's premium positioning. The report highlighted how Starlink Mini can be installed in supersonic jets in just 15-17 days at under $1,000 in equipment costs, compared to GoGo's traditional systems, with Starlink offering business plans starting at $2,000/month for 20GB service that threatens GoGo's $1.64 billion market position serving 8,000 business jets primarily in North America.

| Pocket-Sized Truths: What the Nikola Interview Tells Us About Media Memory is our third deep dive into the Trevor Milton media spectacle, examining how after nearly two hours of the convicted CEO trying to rehabilitate his image, the most viral takeaway wasn't about innocence or guilt—it was a throwaway detail about his accuser's past job, revealing how algorithmic attention rewrites even the most carefully crafted narratives. |

BTCS announced it will pay the first-ever Ethereum dividend and loyalty bonus to shareholders as a strategy to discourage short selling activity.

Soleno Therapeutics faced scrutiny from short sellers regarding its Prader-Willi syndrome treatment development program.

Roblox came under criticism from technology observers questioning whether the platform's user experience and content quality are deteriorating.

Activ8Insights.com is your go-to source for everything in the world of activist short selling. We track every activist short report as it drops, publish in-depth analysis on targeted companies, and scour the web for related news and filings, so you don’t have to. Whether you're an investor, analyst, or just short-curious, we bring the red flags to your inbox in real time.

Visit our Website

Disclaimer

The information provided on Activ8Insights.com—including all articles, reports, commentary, and associated content—is intended solely for informational and educational purposes. It does not constitute investment advice, an offer, or a recommendation to buy or sell any securities. Activ8Insights does not express any opinion on the valuation or future performance of any security mentioned. All views and opinions presented aim to promote transparency and critical dialogue around activist investing—particularly short activism—but should not be interpreted as personalized financial advice. Investors are solely responsible for their own due diligence and investment decisions, based on publicly available information and their individual financial circumstances. We strongly encourage consulting a licensed financial advisor before making any investment decisions. No content published by Activ8Insights constitutes a solicitation or offer to buy or sell securities or financial instruments. Authors, contributors, or affiliates of Activ8Insights may hold long or short positions in the securities mentioned. These positions may change at any time without notice, and there is no obligation to disclose such changes after publication. Any forecasts, estimates, or forward-looking statements are speculative by nature and based on assumptions that may prove inaccurate. They are subject to risks, uncertainties, and change without notice. Activ8Insights makes no commitment to update forward-looking content. Activ8Insights disclaims all liability for any direct or consequential loss arising from the use of content on this site or associated platforms. By accessing this website or our affiliated media, you acknowledge and agree to this disclaimer and our terms of use. Unauthorized reproduction or distribution of this content is strictly prohibited and may result in legal action.