- Activ8Insights Newsletter

- Posts

- Weekly Wrap-Up: Sunday, 08/17/2025

Weekly Wrap-Up: Sunday, 08/17/2025

Three significant activist short reports dominated the week, targeting companies across biotech, defense, and consumer products. Scorpion Capital raised alarming safety concerns about Soleno Therapeutics' newly approved rare disease drug, citing pediatric hospitalizations and trial investigator skepticism. Fuzzy Panda Research exposed operational challenges at Red Cat Holdings despite its recent Army contract win, while The Bear Cave alleged that Fly-E Group's e-bikes are linked to deadly fires in NYC and connected to overseas stock manipulation schemes. Market reactions were mixed, with Fly-E experiencing the most dramatic decline following initial stability—a nearly 87% plunge that puts The Bear Cave definitively in the running to receive Short King of the Month for two consecutive months. Additionally, we released our First Monthly Report this week and are building out enhanced analytics capabilities to provide even deeper insights into activist short selling trends. Notably, judicial action appears to finally be materializing against Roblox after numerous short seller reports—a development we'll be monitoring closely over the coming weeks.

Scorpion Capital Research Report on Soleno Therapeutics (NASDAQ:SLNO)

Report Impact on Stock Price

Scorpion Capital's report on Soleno Therapeutics triggered an immediate 7.4% decline from the previous day's close of $77.36 to an intraday low of $63.46, though the stock partially recovered to close at $71.63. The stock maintained this level through week-end, representing an overall 7.4% decline from the pre-report baseline.

Who is Soleno Therapeutics?

Soleno Therapeutics is a biotech company focused on rare diseases, with VYKAT XR as its flagship product approved by the FDA in March 2025 for treating hyperphagia in Prader-Willi Syndrome patients aged 4 and older. The company's only commercial drug is an extended-release tablet formulation of diazoxide, positioning itself as addressing unmet medical needs in PWS, a rare genetic disorder characterized by insatiable hunger. The company transformed from penny stock status to significant market capitalization following FDA approval.

Key Points from the Report

Safety Crisis: Multiple children hospitalized for potential heart failure and pulmonary edema within weeks of starting VYKAT XR, with reports of extreme fluid retention causing children to gain 10-15 pounds and experience diabetic-level blood sugar spikes

Trial Investigator Rejection: Eight trial investigators expressed broad skepticism with many stating they have no plans to prescribe the drug, citing pressure to conceal toxicity and massive patient discontinuation rates at trial sites

Questionable Clinical Data: The pivotal withdrawal study remains unpublished despite FDA approval, with ex-employees alleging data manipulation and Scorpion identifying fabricated HbA1c data with inconsistent values

Mechanism Concerns: VYKAT XR is merely an expensive reformulation of 50-year-old generic diazoxide, with multiple investigators preferring to prescribe the cheaper generic alternative

Scientific Validity: The report argues diazoxide cannot cross the blood-brain barrier due to its molecular properties, making the claimed CNS mechanism scientifically unfounded

Fuzzy Panda Research Report on Red Cat Holdings, Inc. (NASDAQ:RCAT)

Report Impact on Stock Price

Fuzzy Panda's report caused Red Cat Holdings to drop from $9.37 to an intraday low of $7.90, ultimately closing at $8.41 on the day of release. The stock maintained this level through week-end, representing a 10.2% decline from the pre-report price.

Who is Red Cat Holdings, Inc.?

Red Cat Holdings is a reverse-merger drone company developing small unmanned aircraft systems primarily for military and commercial applications. The company's flagship Black Widow drone was designed for the U.S. Army's Short Range Reconnaissance program, with Red Cat announcing its SRR Tranche 2 program win in November 2024. The company operates through subsidiary Teal Drones and has positioned itself as a key U.S. military drone supplier.

Key Points from the Report

Production Problems: Former employees revealed a 60% failure rate for drones, with hand assembly rather than automated production and 30-minute testing requirements creating significant bottlenecks

Executive Exodus: The CTO and top engineers departed after the Army award, with Red Cat experiencing three CFOs in under two years and key engineering positions remaining vacant

Contract Reality: The actual LRIP contract covers 690 systems (46% smaller than promised), the program is not sole-sourced as claimed, and Army officials expressed concerns about Red Cat's delivery ability

Financial Red Flags: Company issued toxic convertible notes after the Army award and engaged in paid stock promotions despite winning the military contract

Operational Challenges: Minimal capital investment ($1.9M since 2023) indicates lack of automation, while competitor Skydio is already delivering hundreds of drones to the Army

The Bear Cave Report on Fly-E Group, Inc. (NASDAQ:FLYE)

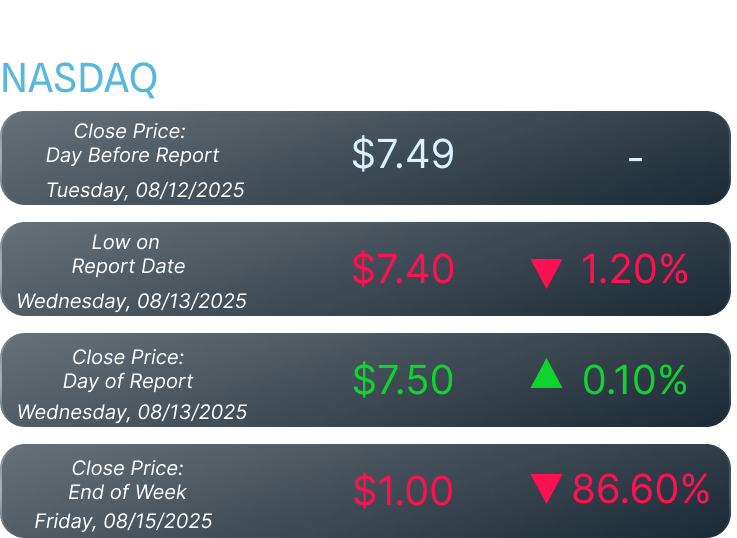

Report Impact on Stock Price

The Bear Cave's report initially had minimal impact on Fly-E Group, with the stock barely moving from $7.49 to close at $7.50 on the day of release. However, by week-end, the stock had collapsed dramatically to $1.00, representing an 86.6% decline from the pre-report baseline.

Who is Fly-E Group, Inc.?

Fly-E Group sells e-bikes primarily to food delivery couriers in New York City, operating with a $136 million market capitalization on NASDAQ. The company runs several franchise locations throughout Manhattan and the greater NYC area, focusing specifically on the delivery worker market segment.

Key Points from the Report

Safety Allegations: Fly-E's e-bikes allegedly linked to multiple deadly lithium-ion battery fires in NYC, including incidents that killed delivery workers and civilians

Regulatory Violations: Company received 77 violations for selling batteries without proper safety certifications and was issued a cease-and-desist letter for selling dangerous batteries online

False Certification Claims: Recently sued by UL Solutions for falsely advertising products as "UL Certified" without proper certification, settling for $1 million while continuing violations

Stock Manipulation Allegations: The Bear Cave claims overseas stock scammers are manipulating FLYE in what appears to be the end stages of a pump-and-dump scheme targeting U.S. investors

Ongoing Regulatory Scrutiny: Faces continued oversight from FDNY and Department of Consumer & Worker Protection for safety and certification violations

| Introducing Activ8Insights Monthly Reports We're launching our first monthly report covering the activist short selling landscape! Our inaugural July 2025 edition tracks 14 major reports, research firm performance, sector trends, and introduces our "Short King of the Month" award. While we're developing more advanced analytics for future editions, this foundational report establishes our comprehensive tracking framework. Expect significant enhancements and deeper insights in the coming months as we build the premier resource for activist short selling intelligence. |

Roblox faces mounting pressure over child safety protocols after banning popular "predator hunter" Schlep and defending the removal of "vigilante" users, triggering a lawsuit from Louisiana's Attorney General alleging the platform "prioritizes user growth, revenue, and profits over child safety," a petition from Rep. Ro Khanna urging stronger protections, and multiple civil lawsuits including one involving a 10-year-old's alleged kidnapping by a predator met through the platform.

Super Micro Computer short-sellers cash in as the server manufacturer's stock plunged nearly 20% following disappointing Q4 earnings that missed analyst expectations across revenue ($5.76B vs. $6B expected), EPS (41¢ vs. 44¢), and gross profit ($551M vs. $601M), with Hazeltree data showing SMCI remained among the 10 most crowded short positions throughout H1 2025 despite hedge funds scaling back tech shorts elsewhere.

Andrew Left's Citron Research targets Palantir's "absurd valuation" as the GameStop short-seller announced he is shorting the S&P 500's best-performing stock this year, arguing that even if Palantir were "the greatest company ever created" with Nvidia-level 2023 multiples, the stock "still can get cut by two-thirds," though Left acknowledged his timing could be wrong given the stock's retail momentum and cautioned his public statements should be viewed skeptically amid his ongoing federal securities fraud case.

Activ8Insights.com is your go-to source for everything in the world of activist short selling. We track every activist short report as it drops, publish in-depth analysis on targeted companies, and scour the web for related news and filings, so you don’t have to. Whether you're an investor, analyst, or just short-curious, we bring the red flags to your inbox in real time.

Visit our Website

Disclaimer

The information provided on Activ8Insights.com—including all articles, reports, commentary, and associated content—is intended solely for informational and educational purposes. It does not constitute investment advice, an offer, or a recommendation to buy or sell any securities. Activ8Insights does not express any opinion on the valuation or future performance of any security mentioned. All views and opinions presented aim to promote transparency and critical dialogue around activist investing—particularly short activism—but should not be interpreted as personalized financial advice. Investors are solely responsible for their own due diligence and investment decisions, based on publicly available information and their individual financial circumstances. We strongly encourage consulting a licensed financial advisor before making any investment decisions. No content published by Activ8Insights constitutes a solicitation or offer to buy or sell securities or financial instruments. Authors, contributors, or affiliates of Activ8Insights may hold long or short positions in the securities mentioned. These positions may change at any time without notice, and there is no obligation to disclose such changes after publication. Any forecasts, estimates, or forward-looking statements are speculative by nature and based on assumptions that may prove inaccurate. They are subject to risks, uncertainties, and change without notice. Activ8Insights makes no commitment to update forward-looking content. Activ8Insights disclaims all liability for any direct or consequential loss arising from the use of content on this site or associated platforms. By accessing this website or our affiliated media, you acknowledge and agree to this disclaimer and our terms of use. Unauthorized reproduction or distribution of this content is strictly prohibited and may result in legal action.