- Activ8Insights Newsletter

- Posts

- Weekly Wrap-Up: Sunday, 07/13/2025

Weekly Wrap-Up: Sunday, 07/13/2025

This Week in Activist Short Selling

This week was anything but quiet in the short activism world. Three high-impact reports targeted companies across crypto, Indian industrials, and autonomous tech, each exposing what researchers allege are deep structural flaws and insider-friendly schemes. From BitMine’s ETH illusion unraveling in spectacular fashion, to Vedanta’s debt-fueled dividend treadmill, to fresh doubts about PONY.ai’s self-driving claims, short sellers are putting high-profile narratives under the microscope. Volatility followed in some cases, while others may be slow-burning time bombs.

Fugazi Research Report on NASDAQ: BMNR

Report Date: Wednesday, July 9th, 2025

Market Impact

BitMine collapsed from $111.50 pre-report to $40.62 by week’s end, a staggering 64% drawdown. The stock tanked over 40% on report day alone, signaling extreme investor alarm and liquidation.

Who is BitMine Immersion Technologies?

Initially a Bitcoin miner, BitMine repositioned itself as an Ethereum treasury vehicle following a $250 million PIPE deal and a move to the NYSE American. Despite this pivot, it holds no ETH, lacks infrastructure, and appears structured primarily to enrich insiders.

Key Points from the Report

Zero ETH Exposure: Company announced a $250M ETH buy but had not purchased any as of July.

Share Scarcity Strategy: Just 3.2M float vs. 62.3M outstanding led to a massive, artificial price surge.

Insider-Friendly Structure: CEO arranged PIPE terms to benefit entities he controls, with guaranteed returns.

Fake Facilities: No proper headquarters; key assets sold to the CEO’s LLC.

Hype via Tom Lee: Appointment of CNBC’s Tom Lee preceded retail buying frenzy—no real governance boost.

Viceroy Research Report on NSE:VEDL.NS

Report Date: Wednesday, July 9th, 2025

Market Impact

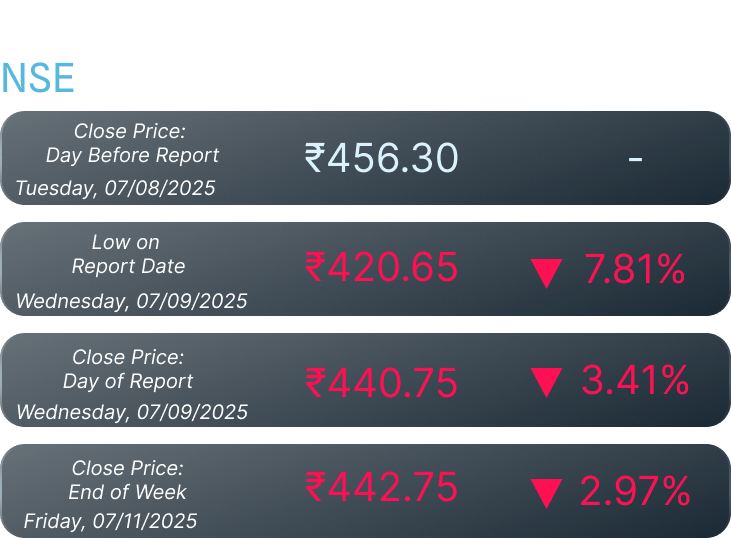

Vedanta’s stock dipped from ₹456.30 to ₹442.75 for the week, after hitting an intraday low of ₹420.65. The mild rebound may reflect investor desensitization to debt concerns—or underestimation of the systemic risks flagged.

Who is Vedanta Limited?

Vedanta is a major Indian industrial conglomerate listed on the NSE, with holdings in metals, energy, and mining. Its parent, Vedanta Resources, is accused of bleeding it dry to service its own $4.9 billion in debt—via excessive dividends, suspect loans, and questionable governance.

Key Points from the Report

Debt-Driven Dividend Drain: VEDL forced to fund payouts with debt despite negative free cash flow.

Hidden Leverage: Interest costs imply far higher borrowing rates than disclosed.

Cash Transfers to Parent: $956M loan for a failed buyout and $338M in dubious brand fees extracted.

Subsidiary Red Flags: Gold laundering, hidden liabilities, and environmental fine cover-ups.

Audit and Regulatory Risks: Aggressive accounting, questionable auditors, and 100+ liability disclosures.

Grizzly Research Report on NASDAQ: PONY

Report Date: Thursday, July 10th, 2025

Market Impact

PONY.ai’s stock remained steady, moving from $12.14 to $12.77 over the week. Despite Grizzly’s claims, the muted reaction suggests markets may be discounting regulatory and credibility risks—for now.

Who is PONY.ai?

PONY.ai is a high-profile Chinese autonomous driving startup with major backers and operations in both China and the U.S. Once valued at over $8 billion, the company claims to operate fully driverless services but is now under fire for allegedly inflating its tech achievements.

Key Points from the Report

Misleading Autonomy Claims: 95% of robotaxis in China still have human drivers.

Regulatory Misrepresentation: Lost key U.S. license in 2022; inflated local Chinese permits to investors.

Safety Obfuscation: Edited ride videos to hide human interventions.

Tech Stagnation: Internally reported lack of R&D progress contradicts public messaging.

Investor Misguidance: Overstates achievements to maintain valuation and market interest.

XP Inc. Takes Legal Aim at Grizzly Research: Brazilian brokerage XP has filed a defamation suit in New York against short-seller Grizzly Research, alleging the firm published a misleading report to tank its share price. Read our Summary on Grizzly Research’s report on XP that drove this lawsuit.

Crackdown on Short Selling in South Korea: In response to rising concerns over market manipulation, South Korea is tightening regulations on short selling—introducing stricter disclosure rules and tougher penalties that could curb aggressive strategies by activist short sellers.

Activ8Finance.com is your go-to source for everything in the world of activist short selling. We track every activist short report as it drops, publish in-depth analysis on targeted companies, and scour the web for related news and filings, so you don’t have to. Whether you're an investor, analyst, or just short-curious, we bring the red flags to your inbox in real time.

Visit our Website

Disclaimer

The information provided on Activ8Finance.com—including all articles, reports, commentary, and associated content—is intended solely for informational and educational purposes. It does not constitute investment advice, an offer, or a recommendation to buy or sell any securities. Activ8 Finance does not express any opinion on the valuation or future performance of any security mentioned. All views and opinions presented aim to promote transparency and critical dialogue around activist investing—particularly short activism—but should not be interpreted as personalized financial advice. Investors are solely responsible for their own due diligence and investment decisions, based on publicly available information and their individual financial circumstances. We strongly encourage consulting a licensed financial advisor before making any investment decisions. No content published by Activ8 Finance constitutes a solicitation or offer to buy or sell securities or financial instruments. Authors, contributors, or affiliates of Activ8 Finance may hold long or short positions in the securities mentioned. These positions may change at any time without notice, and there is no obligation to disclose such changes after publication. Any forecasts, estimates, or forward-looking statements are speculative by nature and based on assumptions that may prove inaccurate. They are subject to risks, uncertainties, and change without notice. Activ8 Finance makes no commitment to update forward-looking content. Activ8 Finance disclaims all liability for any direct or consequential loss arising from the use of content on this site or associated platforms. By accessing this website or our affiliated media, you acknowledge and agree to this disclaimer and our terms of use. Unauthorized reproduction or distribution of this content is strictly prohibited and may result in legal action.